All Categories

Featured

Table of Contents

Area 691(c)( 1) offers that an individual who includes an amount of IRD in gross earnings under 691(a) is enabled as a reduction, for the exact same taxable year, a part of the inheritance tax paid because the inclusion of that IRD in the decedent's gross estate. Typically, the quantity of the deduction is computed making use of estate tax worths, and is the amount that bears the same proportion to the estate tax obligation attributable to the internet worth of all IRD products included in the decedent's gross estate as the value of the IRD consisted of in that person's gross earnings for that taxable year bears to the value of all IRD items consisted of in the decedent's gross estate.

Rev. Rul., 1979-2 C.B. 292, attends to a scenario in which the owner-annuitant purchases a deferred variable annuity agreement that provides that if the proprietor dies prior to the annuity beginning date, the named recipient might elect to receive the existing gathered worth of the agreement either in the type of an annuity or a lump-sum payment.

Rul. 79-335 ends that, for objectives of 1014, the contract is an annuity defined in 72 (as after that effectively), and consequently gets no basis adjustment because the owner's death since it is controlled by the annuity exception of 1014(b)( 9 )(A). If the beneficiary chooses a lump-sum payment, the extra of the amount obtained over the amount of consideration paid by the decedent is includable in the recipient's gross earnings.

Rul. Had the owner-annuitant gave up the agreement and received the amounts in extra of the owner-annuitant's financial investment in the agreement, those quantities would have been income to the owner-annuitant under 72(e).

Joint And Survivor Annuities beneficiary tax rules

Likewise, in today case, had A surrendered the contract and got the quantities at concern, those quantities would certainly have been earnings to A under 72(e) to the extent they surpassed A's investment in the contract. Accordingly, amounts that B receives that surpass A's investment in the agreement are IRD under 691(a).

Rul. 79-335, those quantities are includible in B's gross earnings and B does not obtain a basis modification in the contract. Nonetheless, B will certainly be entitled to a deduction under 691(c) if estate tax scheduled because A's fatality. The result would be the same whether B receives the fatality advantage in a round figure or as periodic repayments.

COMPOSING Details The principal writer of this income judgment is Bradford R.

Are Annuity Contracts death benefits taxable

Q. How are just how taxed as an inheritance? Is there a distinction if I acquire it straight or if it goes to a trust fund for which I'm the beneficiary? This is a great question, however it's the kind you should take to an estate planning lawyer that recognizes the information of your circumstance.

As an example, what is the relationship between the deceased proprietor of the annuity and you, the recipient? What sort of annuity is this? Are you making inquiries around income, estate or inheritance tax obligations? We have your curveball question about whether the outcome is any various if the inheritance is through a depend on or outright.

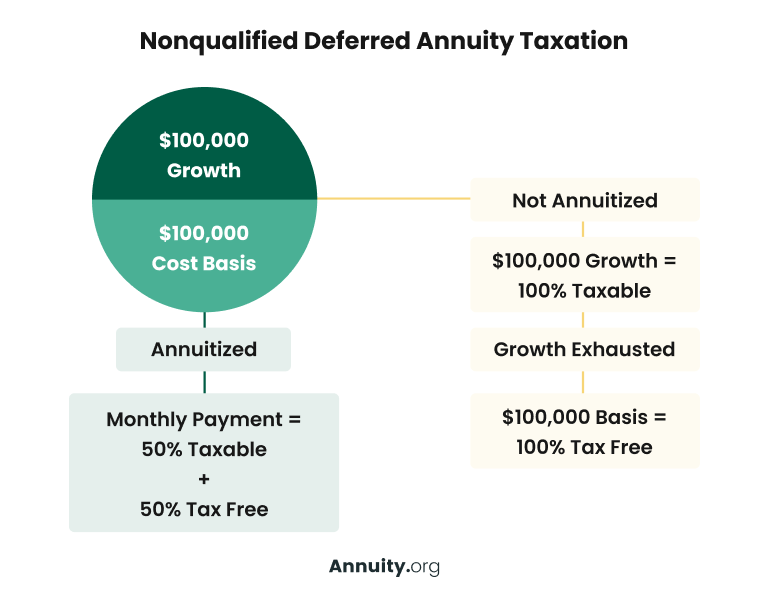

We'll think the annuity is a non-qualified annuity, which indicates it's not part of an Individual retirement account or other competent retired life strategy. Botwinick claimed this annuity would be included to the taxed estate for New Jacket and federal estate tax obligation functions at its date of fatality value.

Tax implications of inheriting a Flexible Premium Annuities

citizen partner goes beyond $2 million. This is referred to as the exemption.Any quantity passing to an U.S. citizen partner will be entirely excluded from New Jacket estate tax obligations, and if the owner of the annuity lives to the end of 2017, then there will be no New Jersey inheritance tax on any quantity because the estate tax obligation is set up for repeal starting on Jan. After that there are government estate taxes.

"Currently, revenue taxes.Again, we're presuming this annuity is a non-qualified annuity. If estate taxes are paid as an outcome of the addition of the annuity in the taxed estate, the beneficiary may be entitled to a deduction for acquired revenue in respect of a decedent, he claimed. Beneficiaries have numerous options to consider when picking how to obtain cash from an acquired annuity.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices Key Insights on Fixed Interest Annuity Vs Variable Investment Annuity What Is the Best Retirement Option? Features of Smart Investment Choices Why Choosing the Ri

Decoding Fixed Income Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Advantages and Disadvantages of Variable Annuity Vs Fixed A

Analyzing Choosing Between Fixed Annuity And Variable Annuity Everything You Need to Know About Retirement Income Fixed Vs Variable Annuity What Is Annuities Fixed Vs Variable? Advantages and Disadvan

More

Latest Posts